What Is The Best Investment

Table of Contents Heading

- Corporate Bonds

- Invest In time Assessment Time

- Learn More About Schwab Intelligent Portfolios »

- Best Investment Sites For Research & Analysis

- Dedicated Financial Advisors Or Teams

- Invest In cushion Time

- Best Investment Company For International Stocks: Interactive Brokers

A good investment firm’s advisors can help you to invest in a way that matches your long-term goals for safety and earnings— AND point out potentially problematic investments or likely underperformers. Utilizing a full-service investment firm doesn’t guarantee you’ll never have losses, but many losses can be avoided or minimized. Discount brokers have their place and many present a great value, but for investors who want professional wealth management, a full-service investment firm could be the answer.

But while over half of the investors that we surveyed in September are concerned about a 2020 recession the majority still expect equities to beat bonds, despite the overwhelming lessons of history. The next six to nine months could be very ugly for equity markets as the reality of recession takes hold. Even U.S. dollar cash yields of 2% may look a good return if equities fall 20%, and there are ultra-short-term bond funds that take a bit more risk and may offer a little more yield. We think tech is over-owned, over-valued and subject to regulatory and tax-related risks. On a 12-month view, our tech caution favors value vs. growth, and we’d look for any short-term economic weakness as an opportunity to make that switch. It would be easy to follow the crowd and recommend equities or Bitcoin. But the current optimism has pushed valuations for global stocks to levels higher than those seen at the peak of the tech bubble in January 2000.

The reality is, people don’t consider the tax consequences of their investments, which can leave you short of your financial goals. Invest in index funds for a more passive approach, compared to buying individual stocks. Let’s take a closer look at some of the most popular investment vehicles. They may not all be appropriate for you today, but over time, the best investments for your needs can change. First, I’d open up a Roth IRA and invest for retirement so my money can grow tax-free.

Ever dreamed of owning one of Warhol’s masterpieces or other incredible art? Masterworks makes it possible, even if you don’t have $1 million or more in your portfolio. A Vanguard Personal Advisor works directly with you to understand your goals and financial needs. From there they implement a financial plan to help you achieve whatever your goals are. The miscellaneous fees and commissions as well as account restrictions such as minimum required balances are a trade-off for service that can’t be found with the lowest cost providers. For most households, it’s easy to establish an amount that can be safely invested on a scheduled basis and that won’t be missed from the budget.

In contrast, companies that generate surplus cash flow today, and return much of that to shareholders, offer immediate returns. With liquidity ebbing, a bird in the hand will be worth two in the bush. In this long-running bull market, investors seek growth and appear indifferent to valuation. For example, the percent of IPOs of companies with negative earnings in the past year exceeds the late 1990s technology bubble highs.

Corporate Bonds

The Phase One U.S.-China deal in December propelled a late-year spike in global stocks and a banner year for global equities. The Federal Reserve has said that it will do whatever it takes, igniting a stampede into stocks. The most common question we have fielded recently is why the S&P 500 has recovered to January 2020 levels when economic growth has contracted, millions are out of work and default rates are surging. The economic data is awful, but the Fed has proclaimed that the printing presses are rolling and they are ready for a shopping spree. Its 12-month forward earnings-per-share growth, led by cyclical stocks, is north of 23% on 9.7% sales growth, according to Bloomberg consensus estimates. A weakening U.S. dollar also gives life to foreign stocks.

Like most brokerage platforms that cater to day traders, TradeStation lacks strong fundamental company research and educational materials. In addition to good software, educational resources and research materials that are all geared toward options trades, tastyworks offers an inexpensive fee schedule. If you want your brokerage to include a top-notch mobile app, there’s a good chance you’ll need to invest with a different company. Day trading.Everything I wrote about options trading also applies to day trading. For instance, Fidelity doesn’t profit by selling your trades to third-party companies, a controversial practice called Payment for Order Flow . The company’s decision to not to use PFOF helps ensure that you’ll get the best possible price on your trades.

Invest In time Assessment Time

Historically, gold has risen the fastest when forward-looking economic measures, such as manufacturing surveys, are falling rapidly. In recent months, economic data has been exceeding expectations by the largest margin in at least a decade. Economic improvement provides a catalyst for closing a yawning performance gap.

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Learn More About Schwab Intelligent Portfolios »

The American public has more than $13 trillion invested through these three brokerage firms. By clicking ‘Sign up’, you agree to receive marketing emails from Insider as well as other partner offers and accept our Terms of Service and Privacy Policy. You’ll pay an initial planning fee of $300 to meet with a certified financial planner and a flat $30 a month for ongoing guidance whenever you need it, but no asset under management fee. Once your balance reaches $50,000, free tax-loss harvesting is available. Then, this female-forward online adviser takes it a step further and considers your gender, lifespan, and earning potential to create a custom portfolio of mostly ETFs. You can also opt for a socially responsible allocation, if that’s important to you.

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. These are companies that own income-generating properties (think malls, hotels, offices, etc.) and offer regular dividend payments. Stock market data may be delayed up to 20 minutes and is intended solely for informational purposes, not for trading purposes. how to buy bonds will help you identify which types to buy and where. best CD rates right now based on term length and account minimums.

Best Investment Sites For Research & Analysis

These two options are definitely better than keeping your money in a savings account at 0.1% interest, where you are actually going to lose money due to inflation. I personally don’t have anything that I am saving for in the short term, so a vast majority of my investments I am holding for the long haul. If I do decide to buy another property in the next few years, then I will plan to take that money out of my brokerage account, or start building a cash reserve once I have a new purchase goal. But since I am not sure that I will buy anything large in the short-term, then I am keeping my investments focused on a longer-term time horizon. There’s a big difference between long-term and short-term investing.

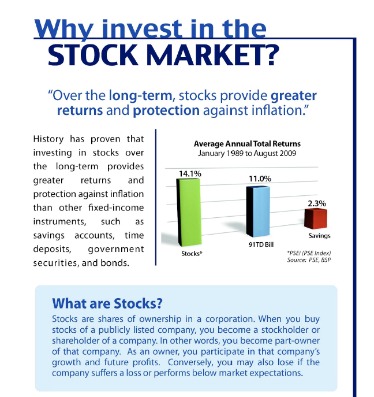

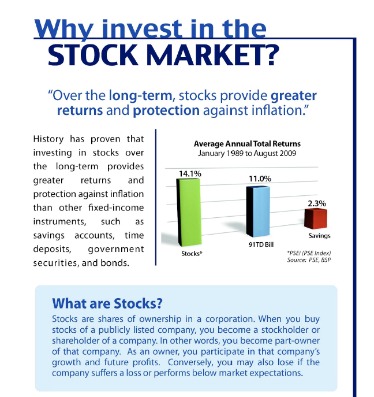

The most successful investors invest in stocks because you can make better returns and retire a lot faster by doing so than with any other investment type. Warren Buffett became a successful investor by buying stocks, and you can too. There are a number of ways to invest in the stock market.

The impact on nearly every asset class available was swift and brutal. The optimism that defined the start of a new decade quickly cycled to anxiety, denial and outright fear. While cities, states and the U.S. government issued stringent health guidelines, the Federal Reserve and Trump Administration committed to massive action to steady financial markets and the economy. The fund has over 38% in software and internet companies, darlings of this year’s rally.

Dedicated Financial Advisors Or Teams

In addition to value, there are two other reasons to consider raising the allocation to energy shares. Historically, energy stocks have been more resilient than the broader market during periods of rising interest rates and/or inflation. If part of what has dislocated the market is the challenge of navigating higher interest rates, energy companies offer a reasonable hedge.

Hi Keith – Since I don’t know you personally, I won’t/can’t make specific investment recommendations. You might want to discuss this with an advisor at Merrill Lynch. As you get closer to retirement, it’s important to reduce your risk as much as possible.

An ETF, or exchange traded fund, is an investment option that owns a basket of underlying assets – like stocks, bonds, or commodities. These assets are typically chosen to create an index that mimics a particular market index or section of the market. The idea is that investors will see the same performance from the ETF as they see in the market as a whole. When it comes to stashing cash for your emergency fund, a money market account is considered one of the best ways to invest money.

- Watchlists, screens, and the number of portfolios you can manage go up with each plan.

- Are you a homeowner looking for a relatively safe way to invest?

- If you are a beginner, start with an app that offers educational resources and assistance from a financial advisor.

- Just remember that it’s OK to be boring with your investments, as Clark has advised many times.

The fault line for equities will likely be the upcoming earnings season. However, the rally in global equities has seen valuation multiples rise, which puts greater emphasis on companies meeting their earnings-per-share forecasts. U.S. companies are already guiding expectations lower, and we expect EPS growth in the coming year to be down 5%, rather than the 7% gain currently forecast by analysts. However, this equity rally has been driven almost entirely by valuation expansion.

As the coronavirus crisis has demonstrated, a seemingly stable economy can be quickly turned on its head, leaving those who haven’t prepared scrambling for income. But those who could hold on to their investments may have done quite well, as the market registered new all-time highs in the second half of last year. Even though annuities can be a good long-term savings solution, they’re actually an insurance contract. Since they’re an insurance product, they’re sold by insurance companies. This means they often come with some relatively hefty commissions, depending on the product. Additional fees could further increase your costs and lower your overall investment return.

Just be sure to familiarize yourself with the real estate market there if you do. One of the advantages of investing elsewhere is that you can find more affordable real estate by not limiting yourself to one geographic region. Real estate investors are clamoring for distressed homes that will sell for significantly less than market value in hopes of making a profit. These rental property investments can run the gamut from single-family dwellings to townhomes and small or large high-rise condominiums. As you can see, there are plenty of diverse investment opportunities out there!

In other words, you must be comfortable with the idea to be successful with it. Because, during challenging times, borrowers are more likely to default on a home they aren’t living in. Moreover, mortgage insurance isn’t available for investment properties. This is why lenders often require a large down payment of 20% to 30%.

Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear.

Best Investment Company For International Stocks: Interactive Brokers

For one, you are more likely to understand companies that have meaning to you. In other words, you know what the company does, how it works, and how it makes money. One important factor to consider when analyzing the investment potential of a company is its management. Your employer typically only matches up to a certain amount. So, instead of dedicating money to “saving” with every paycheck, dedicate it to “investing”. It is, of course, a good idea to have a small portion of money set aside in an easily accessible account for emergencies. The next step is to figure out how much money you want to invest.