Us Treasury Holdings By Country

Table of Contents Heading

- Understanding The Budget

- Whats Behind The Huge Spike In Reserves, A Liability On The Feds Balance Sheet?

- Impact Of China Buying U S. Debt

- # Querying The Data

- U S. Treasury Foreign Buyers And Holders : Foreign Official

- Treasury Coupon

- Financing The Government

- Other Statistics On The Topicnational Debt

If he is correct then the trade is in swapping Treasuries for commercial paper in money market funds. This can be extremely profitable because commercial paper is higher yield and extremely marketable. You can sell the paper and pocket the profit right away, no need to wait for Treasury maturity. However distant that possibility, the mere prospect of it, or the prospect of what might happen in Italy, is sending plenty of investors to feed on the richer yields sprouting in less chaos, for the moment at least, across the Atlantic.

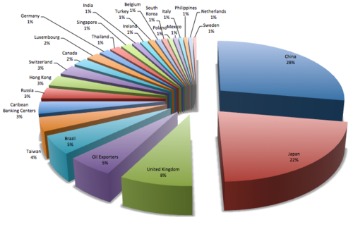

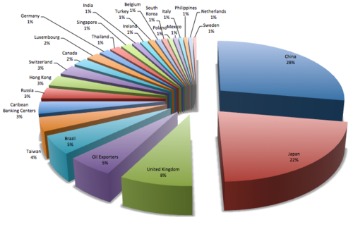

The gold reserve held by the Department of the Treasury is partially offset by a liability for gold certificates issued to the Federal Reserve Banks at the statutory rate, which Treasury may redeem at any time. The 1-year constant maturity rate for Treasury bonds has been steadily increasing for the last several years. Encouraging considering the half-decade of less-than-one-percent yields on the same bonds during the economic recovery following global financial downturn. The pie chart drop-down list selects a specific country and displays the amount of Treasury bonds held as a portion of the whole. The ongoing worries about China’s increased holding of U.S. Treasurys or the fear of Beijing dumping them are uncalled for. Even if such a thing were to happen, the dollars and debt securities would not vanish.

Understanding The Budget

China began reducing its forex reserves in July 2014 over concerns that forex reserve level was too high. In January 2017, Chinese forex reserves dipped below $3 trillion briefly and has since remained above it. The list below is mostly based on the latest available IMF data, and while most nations report in U.S. dollars, a few nations in Eastern Europe report solely in Euros. And since all the figures below are in U.S. dollar equivalents, exchange rate fluctuations can have a significant impact on these figures. Chinese purchases of US state debt have been decreasing over recent months. The latest drop comes on top of the escalating trade conflict between Beijing and Washington over trade imbalance, market access and alleged stealing of US technology secrets by Chinese corporations. So far, the US has imposed tariffs on $200 billion of Chinese goods and Beijing retaliated with tariffs on $60 billion of US goods and stopped buying American crude.

To help prop up the economy, the U.S. unveiled the $2 trillion CARES Act, the largest economic stimulus package in history—near 10% of national gross domestic product. In February 2020, the novel coronavirus was finally named COVID-19. In addition, the Diamond Princess cruise ship was linked to 624 confirmed cases in late February—the highest case cluster outside of China at the time. The ship captured international headlines when it was refused port in a number of countries, casting COVID-19 into the spotlight. In the new year, the first coronavirus cases began filtering outside of China, to Thailand and the U.S.—causing the WHO to declare a public health emergency of international concern. As the death toll ticked up to over 200, it was clear that this was no ordinary virus. That said, with foreign nations holding U.S. debt, such a risk will always exist.

Whats Behind The Huge Spike In Reserves, A Liability On The Feds Balance Sheet?

According to the Fed itself, it holds no gold on its own behalf, but acts as custodian for other countries’ gold. Recently there has been some speculation that the Fed does not have the gold it claims to hold on behalf of other countries. For example, in January 2013, Germany requested the repatriation of a portion of its gold held by the Fed and their request was meet with an initial denial and a promise to return only some of the requested amount over seven years. Slowly, Germany’s gold appears to be making it back. Russia has the sixth largest gold reserves of any nation. China updated its gold reserves last year for the first time in six years and has updated them monthly since July 2015k.

Marketable securities are negotiable and transferable and may be sold on the secondary market. Treasury securities, Agencies, and for a very small part others marketable and non-marketable securities, held in custody or not. It is the sum of all countries & international investors holdings , as detailed in the last section of this page. The Russian central bank has continued getting rid of US Treasury bonds, with the share of investments in American debt shrinking 19.2 percent in November, according to the US Treasury Department. the aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported. You report the accounts by filing a Report of Foreign Bank and Financial Accounts on FinCEN Form 114. The Federal Reserve’s purchase of longer-term Treasury securities is part of their efforts to support the economy through quantitative easing.

This motivation refers to investors who believe that using ESG can improve their portfolio’s long-term results. One way this can be achieved is by investing in companies that have the strongest environmental, social, and governance practices within their industry. Environmental, social, and governance factors are a set of criteria that can be used to rate companies alongside traditional financial metrics. In January 2021, WHO organized an international scientific consultation around these variants. Existing and emerging vaccines will still potentially provide adequate protection against these variants. Multiple countries locked down their borders to the rest of the world, from the European Union to India. These travel bans and reduced mobility affected not just airline revenues, but temporarily had a noticeable effect on carbon emissions too.

The country has earned a reputation for being a front for sovereign wealth funds and hedge funds whose owners don’t want to reveal their positions. The United Kingdom is the third-largest holder with $425 billion. Its holdings have increased in rank as Brexit continues to weaken its economy. It’s followed by Hong Kong with $267 billion and Brazil with $266 billion. On March 15, 2020, the Federal Reserve announced it would purchase $500 billion in U.S. Treasuries and $200 billion in mortgage-backed securities over the next several months. Thisquantitative easingstimulated the economy by keeping interest rates low, and infusing liquidity into the capital markets, giving businesses continued access to low-cost borrowing for operations and expansion.

Impact Of China Buying U S. Debt

China’s strategy is to maintain export-led growth, which aids in generating jobs and enables it, through such continued growth, to keep its large population productively engaged. Since this strategy is dependent on exports (over 16% of which went to the U.S. in 2019), China requires RMB in order to continue to have a lower currency than the USD, and thus offer cheaper prices. To keep its export prices low, China must keep its currency—the renminbi —low compared to the U.S. dollar. China is primarily a manufacturing hub and an export-driven economy. Census Bureau shows that China has been running a big trade surplus with the U.S. since 1985. Please speak to a licensed financial professional before making any investment decisions.

Currency depreciation is when a currency falls in value compared to other currencies. Easy monetary policy and inflation can cause currency depreciation. China, on the other hand, needs to be concerned about loaning money to a nation that also has the limitless authority to print it in any amount. High inflation in the U.S. would have adverse effects for China, as the real repayment value to China would be reduced in the case of high inflation in the U.S. and with that large amount of money involved, Treasuries are probably the best available option for China. Buying U.S. Treasurys enhances China’s money supply and creditworthiness. Selling or swapping such Treasurys would reverse these advantages.

# Querying The Data

Since FY1960, the federal government has run on-budget deficits except for FY1999 and FY2000, and total federal deficits except in FY1969 and FY1998–FY2001. Conceptually, an annual deficit should represent the change in the national debt, with a deficit adding to the national debt and a surplus reducing it. However, there is complexity in the budgetary computations that can make the deficit figure commonly reported in the media (the “total deficit”) considerably different from the annual increase in the debt. The major categories of differences are the treatment of the Social Security program, Treasury borrowing, and supplemental appropriations outside the budget process.

The fall marks the fourth straight month of declines. China is followed by Japan, whose share of US Treasuries fell to $1.03 trillion, the lowest since October 2011. China gets a lot of attention for holding a big chunk of the U.S. government’s debt and for good reason, given its rapidly expanding economy.

U S. Treasury Foreign Buyers And Holders : Foreign Official

While money market funds by definition will directly hold only short term Treasury securities, they indirectly hold long term Treasury securities through repurchase agreements collateralized by Treasury Notes, and Bonds. These nations now realize they don’t need to hold large US dollars reserves. That to their minds are now riskier to hold, because of the growing massive debt level.

In the international finance system, U.S. debt can be bought and held by virtually anyone. Russian Federation release both weekly and monthly data of its reserves.

Only debt held by the public is reported as a liability on the consolidated financial statements of the United States government. Debt held by government accounts is an asset to those accounts but a liability to the Treasury; they offset each other in the consolidated financial statements. Government receipts and expenditures are normally presented on a cash rather than an accrual basis, although the accrual basis may provide more information on the longer-term implications of the government’s annual operations. The United States public debt is often expressed as a ratio of public debt to GDP. The ratio of debt to GDP may decrease as a result of a government surplus as well as from growth of GDP and inflation.

Treasury Coupon

Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness. GDP is a measure of the total size and output of the economy. One measure of the debt burden is its size relative to GDP, called the “debt-to-GDP ratio.” Mathematically, this is the debt divided by the GDP amount. The Congressional Budget Office includes historical budget and debt tables along with its annual “Budget and Economic Outlook.” Debt held by the public as a percentage of GDP rose from 34.7% GDP in 2000 to 40.5% in 2008 and 67.7% in 2011. Mathematically, the ratio can decrease even while debt grows if the rate of increase in GDP is higher than the rate of increase of debt. Conversely, the debt to GDP ratio can increase even while debt is being reduced, if the decline in GDP is sufficient.

Of course, a kick the can measure will be enacted to eliminate this need and exiters will be able to thumb their noses at sovereign debt they issued which is owned by the ECB. Inflation only occurs if there is too much money chasing limited supply of goods. So many of the screaming meamies who are going after Trump today are the ones who fear the loss of their ‘thing’ since he has so little respect for the Establishment and the schemes and/or scams they have built up over the decades. Free stuff or big pay for little work for the connected, paid for with debt, low rates, probable NIRP if Hillary or a stock Republican won, is at stake and a possible reward if Trump can be hounded under control. Where I am hesitant is, at this time, criticizing Trump for wanting to remove regulations. No, I don’t want poison water, toxic air, or thieving banks waiting for socialized losses to kick in once again.

As of February this year, Hong Kong holds $249.8 billion worth of Treasury securities. Some experts believe that Chinese government entities could be buying the Treasury securities via Hong Kong. A lot of emerging market countries are exporting economies. Their exports will no longer be as attractive if their currencies become too strong. By buying up U.S. dollars, they boost its demand, strengthening the greenback and comparatively weakening the emerging currencies. “Perhaps ironically, further dollar weakness could spur central banks to increase their Treasury holdings, as central bank often intervene by purchasing dollars to prevent their currencies from appreciating too much,” he said. He flagged the reserves of countries such as Taiwan and Singapore, which have increased “noticeably” since March.

- Thus, excessive foreign holdings may be attributed to countries that are majorcustodial centers, such as the United Kingdom, Switzerland, Belgium , and Luxembourg .”

- The U.S. federal government is obligated under current law to make mandatory payments for programs such as Medicare, Medicaid and Social Security.

- While money market funds by definition will directly hold only short term Treasury securities, they indirectly hold long term Treasury securities through repurchase agreements collateralized by Treasury Notes, and Bonds.

- Overtaken by Japan last year, China remained the second-largest foreign holder of U.S. government debt.

- Former Congressman Ron Paul’s 2011 request to audit Fort Knox remains unanswered.

- U.S. states have a combined state and local government debt of about $3 trillion and another $5 trillion in unfunded liabilities.

However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around. According to Paul Krugman, “America actually earns more from its assets abroad than it pays to foreign investors.” Nonetheless, the country’s net international investment position represents a debt of more than $9 trillion. U.S. intra-governmental debt components, which totaled $5.47 trillion as of September 2016.

Other Statistics On The Topicnational Debt

However, there has been a drop in Ireland’s U.S. debt holdings, signaling a possible change in multinational attitudes as they move money back to the U.S. as rules on how foreign earnings are taxed change. Ireland holds $300 billion in U.S. debt, which is 4% of foreign debt. Japan is the largest foreign holder of public U.S. government debt, owning $1.266 trillion in debt as of April 2020. Nationality-based data is available from the Federal Reserve Board staff for . These FRB staff data are based on the nationality of the issuer of the foreign security; in contrast the TIC report on U.S. portfolio holdings of foreign securities is based on the residence of the issuer of the security. Many people believe that much of U.S. debt is owed to foreign countries like China and Japan.

Treasury securities are considered cash equivalents and they are the collateral of choice in the financial markets. If you can buy treasuries cheaper than other assets of similar duration, you can use them in a swap transaction, then you let the other party keep the collateral. You are swapping assets of equal face value but you bought yours cheaper, so you make money on the swap.

Treasury Yields

Whether the account produced taxable income has no effect on whether the account is a “foreign financial account” for FBAR purposes. Receive the latest gold research and data to your inbox. A time series of global gold mine production by country. A comprehensive time series of gold demand – broken down by sector and country – and gold supply – broken down by mine production, recycling and producer hedging. These dollars need to be invested somewhere, and the U.S. Treasury market, due to its enormous size, was one of the few places that China could recycle its surplus greenbacks without disrupting the market.

Approximately $7.7 trillion relates to Social Security, while $38.2 trillion relates to Medicare and Medicaid. In other words, health care programs will require nearly five times more funding than Social Security.